The 5 hidden costs of selling a property

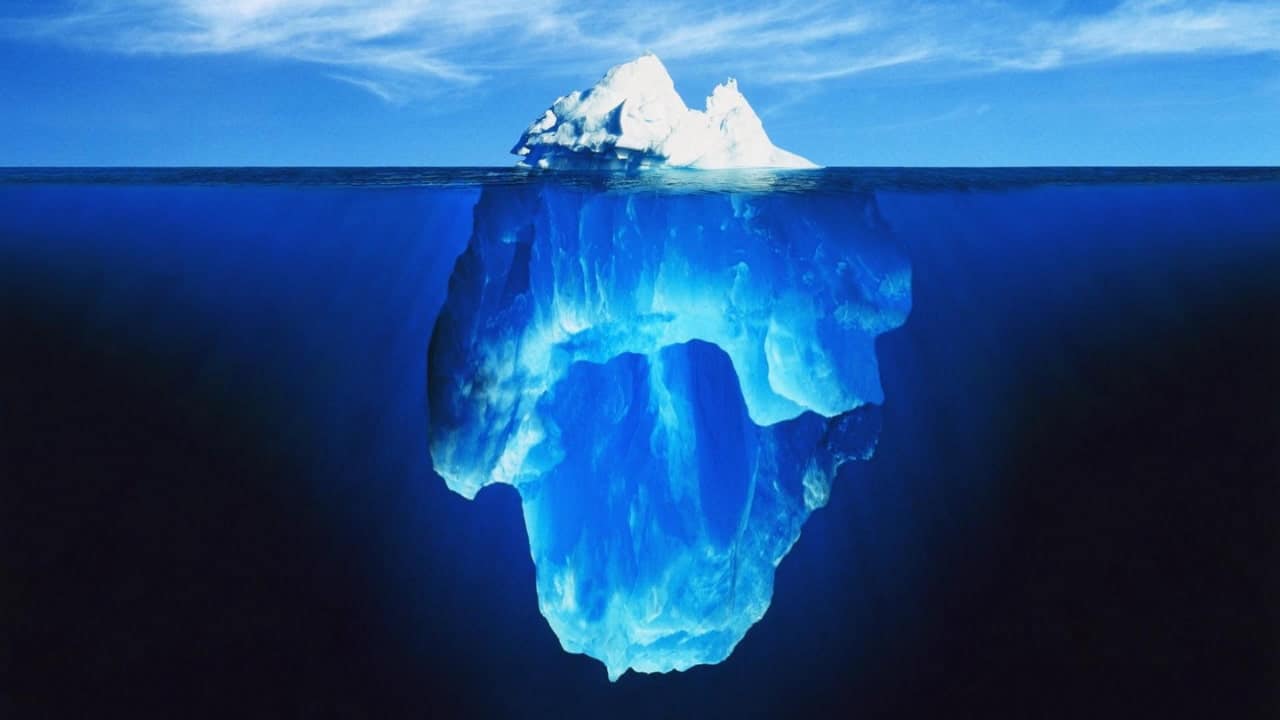

You've finally found the gem you're looking for for the purchase of a property in Collioure or any other town in France, and you've estimated your budget accurately. But before you take the plunge, have you considered all the associated costs? Often overlooked, "hidden costs" can creep into your budget and disrupt your real estate project. So how do you avoid these pitfalls? Paradise Immobilier offers you a non-exhaustive list of the hidden costs of buying real estate.

The reality of sales costs

Hidden costs are surprise expenses that arise during the sales process. Unexpected repairs to make your apartment more attractive, legal fees, taxes - these costs can take many forms and add up quickly, driving up your budget without you even realizing it.

Understanding these costs before buying an apartment or house should be a priority. This will allow you to plan your budget in advance.

1. Real estate agency fees

Finding accommodation can often take a long time. To speed up the process, you can use a local real estate agency and this comes at a price.

- Agency commissions

The agency commission are the main fees you pay when buying a property. On average, these commissions vary between 3% and 8% of the property price. This range depends on various factors such as region, type of accommodation, and even the agency's reputation. Luxury properties, for example, can often entail higher commissions.

Beware: a higher commission does not always guarantee better service. It's up to you to negotiate with the agency and discuss costs openly to make sure you pay a fair and equitable rate.

- Additional services

If you are selling your house in Collioure for example, or your apartment, some real estate agencies may charge for additional services such as document preparation or administrative fees. For example, professional photos, virtual tours or premium listings can be additional services that enhance your property's visibility, but also come with their own cost.

Before signing a contract with an agency, make sure you understand what services are included in the basic commission and what services you may be charged extra for.

2. Legal and administrative costs

When you embark on a real estate transaction, real estate law professionals are there to support you. Legal and administrative costs are essential elements of any transaction. They ensure the security and conformity of the transaction.

- Notary fees

These fees include the costs of drawing up the deeds of sale and registering them, as well as the notary's fees and disbursements (expenses incurred by the notary on your behalf). In general, notary fees represent around 2 to 3% of the purchase price if the property is new, and 7 to 8% if it is old. Read our articles on the subject: How much does a notaire charge to buy a house? or who pays the notary to buy a house .

- Mandatory certifications and diagnostics

Before putting a property on the market, it is necessary to carry out certain diagnostics. These often include energy performance diagnostics (DPE), natural and technological risk assessments(ERNMT), and asbestos diagnostics, among others. The total cost of these certifications can vary, but it's wise to budget a few hundred euros to ensure that your property complies with legal requirements.

Read our articles on the subject: Can you sell a house without a real estate diagnosis?

- Sales taxes

When you sell, you have to take taxes into account. Real estate capital gains are one of the most important elements. This is the difference between the purchase price and the sale price, and part of this capital gain may be subject to tax. You can find out more in our article on tax exemption on the sale of your home .

There are also other taxes linked to the sale, such as property tax and council tax, which can vary depending on the time of year of the sale.

3. Brokerage fees

If you choose to buy, you'll need to estimate a budget. You have two options: discuss it with your bank, or use the services of a mortgage broker. The broker is there to negotiate good conditions for your loan. It can help you obtain lower interest rates and more flexible repayment terms, which can make a big difference to the length of your loan.

You will therefore have to pay him brokerage fees . These fees are generally around 1% of the mortgage.

Some brokers, paid by the banks, are free but may charge additional fees. Once again, you can negotiate to reduce costs.

4. Payment on account

You are planning buying an apartment in Collioure ? So don't forget to include the deposit. It usually represents around 5% to 10% of the total price of the house. If your offer is accepted, this deposit will be deducted from the total price of the house. However, if the sale does not materialize, there is a risk of losing this sum.

5. Renovation and upgrading work

Once you've bought your property, you may need to carry out some work to bring it up to standard. These are major investments that many homeowners forget to budget for.

- Renovations after purchase

Renovation work after purchase is often necessary to personalize the space or remedy any defects. In the case of older homes, it's essential to allow for these additional costs to modernize infrastructure, renew coatings, or bring aging installations up to standard, and to include them in your budget.

Note that new homes are not immune to costs. An off-plan (or VEFA) purchase may also require modifications, such as replacing toilets, which could prove costly.

In another case, if your home is in a condominium and work has been voted on (installation of an elevator, facade renovation, etc.), you will have to pay part of the cost, even if you don't want to. Take a close look at the latest general meeting minutes to see if any work is planned.

- Upgrading to standards

Bringing a property up to standard, whether in terms of electricity, gas or other safety aspects, is an often overlooked element of hidden costs. While these adaptations are essential to guarantee the safety of your living space, they also generate additional costs.

Other costs not to forget

Having explored all the costs to consider when buying a property, we can now turn our attention to other actions that generate further hidden costs. Protecting your home or moving house are actions you need to integrate into your budget planning to avoid surprises.

- Home insurance

Home insurance is essential protection for your new living space. In the event of an unforeseen incident such as fire, water damage or even theft, a good home insurance policy can help you avoid unexpected expenses. It is advisable to budget for this aspect to ensure your household's financial security.

- Moving expenses

Moving costs are a fact of life. Whether you call in professional movers or opt for a more DIY approach, there are associated costs. Trucks, packing materials and even movers can be added quickly.

- Financing costs

If you opt for a bridging loan to facilitate the purchase of your new home in Collioure before the sale of your old one, or if you prepay an existing loan, additional charges may apply. Understanding these potential costs and incorporating them into your financial plan helps avoid disappointment during the purchasing process.

Avoid surprises: planning and budgeting

Here are a few tips to help you avoid surprises related to hidden costs when buying real estate:

- Read the sales contract carefully. This document must specify all costs and charges associated with the purchase, including notary fees, agency fees, taxes, etc.

- Use a real estate agency to guide you through the process.

- Don't hesitate to negotiate fees. Agency fees, for example, are often negotiable.

- Anticipate renovation work.

- Check condominium fees.

- Leave a margin in your total budget to better manage unforeseen events.

Buying a property is an expensive project, and requires careful budgeting. Paradise Immobilier, your real estate agency in Collioure, will guide you through the buying process to help you avoid hidden costs. Ask for a detailed quote!

FAQ

- What are the additional costs involved in buying an apartment?

Buying an apartment usually comes with additional costs, such as notary fees, real estate agency fees, any warranty fees, and the cost of any renovations or alterations.

- How to avoid notary fees when buying real estate?

Notary fees are legally binding in France. However, the amount may vary. To reduce these costs, some people opt for older properties, which have lower notary fees than new ones. Another option is to sign a compromis de vente, with the buyer paying the agency fees.

- How does buying an off-plan apartment work?

Off-plan purchasing, also known as VEFA (Vente en l'Etat Futur d'Achèvement), involves buying a property before it has even been built. The process includes specific steps, including the signing of a reservation contract, followed by a final sales contract once construction is complete.

- Who pays the preliminary sales agreement fees?

Compromise fees are generally payable by the buyer. However, this can be negotiated between the parties when the compromise is drawn up.

- What is a hidden defect?

A hidden defect is a fault that is not apparent at the time of purchase, rendering the item unfit for use or reducing its value. The buyer can claim compensation if he discovers a hidden defect after the sale.

- What is the time limit for hidden defects in my home?

The time limit for taking action in the event of a latent defect is two years from the discovery of the defect. The buyer must inform the seller as soon as possible of the defect, so that legal action can be taken if necessary.

You may also like :

- 10 Tips to prepare your apartment for a quick sale

- Property title definition

- Essential documents to sell your home in 2024 - Complete Guide

- 7 tips for successful home visits

- Buying a condominium: weigh the pros and cons

- How can renovation boost the resale value of your home?

Sources :